Nvidia, a titan in the GPU market, recently faced a slight decline in its stock price after announcing impressive financial results. Despite this dip, savvy investors might view it as a prime opportunity to buy into a company poised for considerable growth.

The company’s recent fiscal report for the third quarter painted a strong picture, revealing a staggering revenue of $35.1 billion, surpassing the predicted $33.2 billion. This remarkable figure marks an impressive 94% increase compared to the previous year. Notably, Nvidia’s data center revenues alone constituted $30.8 billion, showcasing a phenomenal 112% growth driven mainly by GPU sales.

Nvidia is currently launching its revolutionary Blackwell architecture, which has already attracted significant orders from major players like Microsoft and Oracle. The company shipped an impressive 13,000 units in the recent quarter, with projections suggesting a leap to as much as 300,000 units in upcoming months, with forecasts approaching 800,000 by early 2025.

As the demand for advanced AI technologies skyrockets, Nvidia is well-positioned to benefit from substantial investments. Analysts predict that the rising need for cutting-edge GPU capabilities could lead Nvidia’s stock price to soar significantly over the next year. With its current performance and promising projections, this stock dip might just be a fleeting moment in an upward trend for Nvidia investors.

Is Nvidia’s AI Surge a Double-Edged Sword for the Global Economy?

Nvidia’s meteoric rise in the world of technology, particularly in the artificial intelligence (AI) realm, has far-reaching implications that extend well beyond its stock value and financial reports. As the company’s GPUs become increasingly integral to AI development, the impacts on people, communities, and countries are becoming more pronounced.

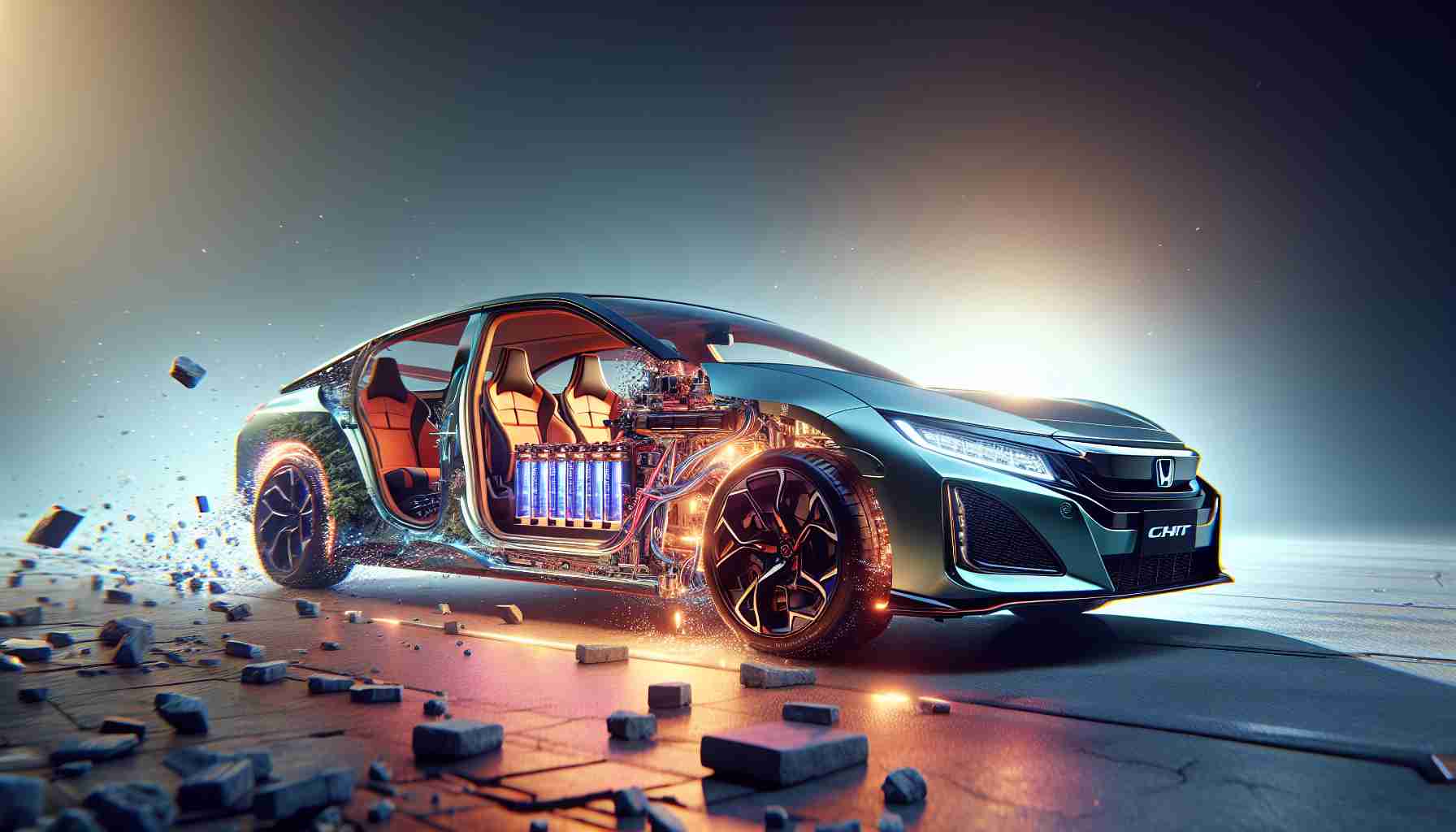

One intriguing fact is the significant role Nvidia plays in the global AI ecosystem. Its products are not only found in data centers of tech giants but are also utilized in various sectors such as healthcare, finance, and automotive industries. This widespread adoption has the potential to transform everyday lives. For instance, AI-driven advancements in healthcare can lead to more personalized medicine, improved diagnostic tools, and automated administrative tasks, thus allowing healthcare professionals to focus more on patient care.

However, these advancements do not come without controversy. As Nvidia’s technology drives automation forward, there are legitimate concerns about job displacement. Many workers in industries such as manufacturing and logistics face the risk of being replaced by AI-driven systems. This creates a pressing question: How will societies adapt to a workforce increasingly replaced by automation? The answer lies in investing in education and reskilling programs to equip individuals with the necessary skills for emerging job roles that AI cannot easily replace.

In addition, while Nvidia’s technology is propelling innovation, it also raises concerns about the ethical use of AI. Issues related to privacy, data security, and biased algorithms have sparked debates on how to govern AI deployment responsibly. For example, as AI systems become more capable, the potential for misuse increases, leading to calls for stricter regulations to ensure these technologies serve society positively and justly.

Moreover, Nvidia’s dominance in AI raises geopolitical concerns. Their technology can be a powerful asset in military applications, and countries may seek to develop their capabilities to compete effectively. Tensions could rise as nations strive for technological superiority in AI, reminiscent of past arms races. This brings about the question, Is the global competition for AI capabilities fostering a new kind of arms race? Yes, experts warn that without international regulations, the race for AI supremacy could lead to destabilizing effects on global security.

On a positive note, Nvidia’s advancements offer incredible opportunities for innovation-led economic growth. Communities that embrace new technologies can drive job creation in AI-driven sectors, scientific research, and sustainability initiatives. The investments in AI infrastructure can spur local economies and inspire the next generation of tech entrepreneurs.

However, the dependency on a single company for critical AI infrastructure, such as Nvidia, can create vulnerabilities. What happens if there’s a supply chain disruption or a dip in Nvidia’s growth? The reliance on their technology could impede progress in industries that are increasingly dependent on robust AI solutions.

In conclusion, while Nvidia’s inventions present clear advantages in boosting productivity and innovation, the ramifications on employment, ethical standards, and global political dynamics cannot be ignored. The world stands at a crossroads, where the decisions made about utilizing AI technology will shape societies for generations to come. To understand more about the implications of AI and technology competition, visit Forbes for in-depth articles and analysis.