- Dell Technologies remains a strong contender in the AI market, despite fluctuations in investor confidence.

- Elon Musk’s startup, xAI, plans a $5 billion investment in Dell’s AI servers, boosting Dell’s market prospects.

- Dell’s leadership, noted for strategic foresight, positions the company as “ahead of the game” in AI innovation.

- Investors face choices between reliable giants like Dell and high-risk, high-reward emerging AI firms.

- Under-the-radar AI disruptors offer potential growth opportunities amid a crowded market.

- The market requires a balance between bold and cautious strategies, recognizing tech cycles’ peaks and valleys.

- Dell exemplifies strategic success in navigating the complexities and uncertainties of AI investments.

Amid the bullish rise and surprising stumbles of the artificial intelligence (AI) market, Dell Technologies Inc. emerges as a sturdy contender. As investors weather the market’s fluctuating moods, integrity and potential become the guiding beacons.

The siren call of AI stocks has entranced investors worldwide, but lately, whispers of uncertainty drift among traders. Analysts speculate the bubble might burst, yet many are convinced we’re merely in the eye of the AI storm. This phase, marked by uncertainty, echoes the familiar rhythm of tech booms: excitement, skepticism, and eventual stabilization.

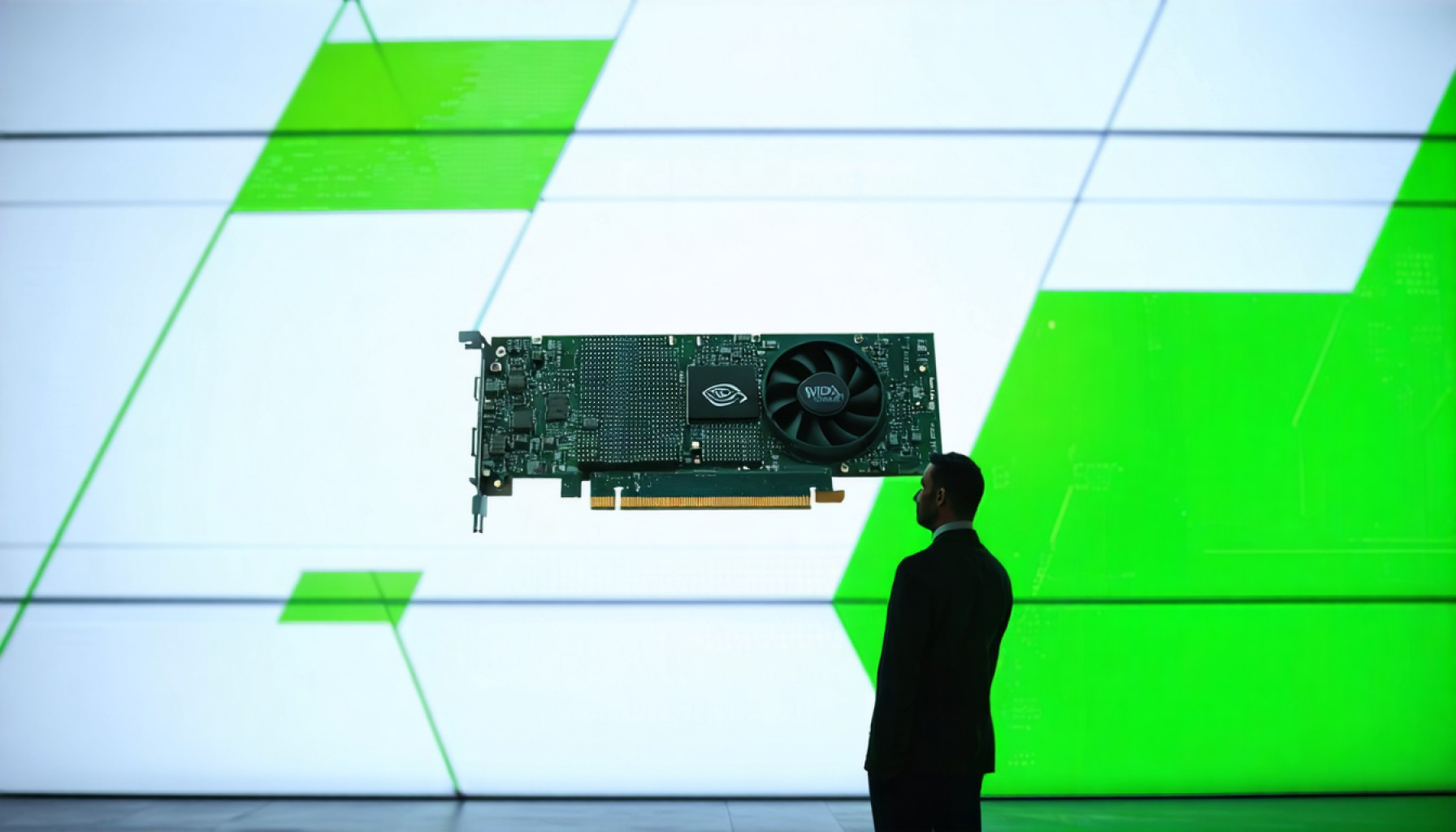

A spotlight illuminates Dell Technologies amid this atmosphere of mixed signals and shifting tides. A report unveiled plans by tech tycoon Elon Musk’s startup, xAI, to procure Dell’s AI servers for a staggering $5 billion, injecting new vitality into Dell’s market prospects. Known for steering innovation with a steady hand, Michael Dell positions his company as one “ahead of the game,” according to financial pundits. Their confidence lies not only in Dell’s hardware prowess but also in its strategic foresight.

Investors keen to ride the AI wave now face a compelling question: Stick with established titans like Dell, or dive into lesser-known stocks with potentially higher risk—but greater reward? Savvy investors recognize that while Dell basks in the glow of industry buzz, it’s not the only player on the field destined for victory.

The current focus extends beyond Dell, towards under-the-radar firms standing poised for substantial growth. These AI disruptors, gleaming with promise, often become the hidden gems in a sea of giants. As the market continues to navigate uncertainty, these burgeoning companies offer tantalizing opportunities for growth-driven investors.

In the broader scheme, the Dell affair reiterates a timeless lesson: Investing in technology demands a balance of boldness and prudence. Understanding the trajectory of market cycles—viewing momentum not as an endless cascade, but as a series of peaks and valleys—ensures readiness for the road ahead.

For the discerning investor, the challenge remains to differentiate between fleeting hype and sustained innovation—a quest that unfolds continuously, offering both lucrative returns and invaluable lessons along its unpredictable path.

In this venture, Dell stands tall—a testament to careful strategy amid chaos—reminding us all of the power in embracing both anticipation and caution as we delve into the dazzling yet demanding world of AI stocks.

Is Dell Technologies the Safest Bet in the Volatile AI Market?

Navigating the AI Investment Landscape

The artificial intelligence (AI) market is a rapidly evolving landscape, characterized by significant strides and occasional setbacks. Dell Technologies Inc. emerges as a formidable player amid these market dynamics, bolstered by the recent announcement that Elon Musk’s startup, xAI, plans to purchase Dell’s AI servers for $5 billion. This move underscores Dell’s growing prominence in hardware solutions tailored for AI advancements.

Dell’s Strategic Position in AI

Dell’s strength lies not only in its robust hardware offerings but also in its strategic foresight. Under Michael Dell’s leadership, the company has consistently been at the forefront of technological innovation, strategically positioning itself to capitalize on the growing demand for AI solutions. By aligning with significant ventures like Musk’s xAI, Dell enhances its credibility and secures a pivotal place in the AI market.

The Balance of Risk and Reward

Investors are torn between sticking with established tech leaders like Dell or venturing into lesser-known companies with the potential for higher returns but increased risk. While Dell’s established reputation offers stability, the allure of unknown startups often captivates those hungry for exponential growth.

Emerging AI Disruptors

While Dell shines under the spotlight, various under-the-radar firms are poised for substantial growth in the AI sector. These disruptors may lack the immediate visibility of giants but are often at the cutting edge of innovation, offering lucrative opportunities for savvy investors willing to explore beyond traditional stocks.

Predicting AI Market Trends

1. Continued Growth: The AI market is expected to continue its upward trajectory, with sectors such as healthcare, autonomous vehicles, and virtual assistants driving demand.

2. Increased Competition: As AI becomes integral across industries, competition among companies will intensify, pushing innovation to new heights.

3. Regulatory Challenges: With rapid advancements, regulatory bodies may impose new guidelines, impacting how companies operate within the AI realm.

Real-World Use Cases: Dell’s AI Influence

Dell’s servers and hardware solutions are critical in diverse sectors:

– Healthcare: Enhancing diagnostics and patient care through AI-driven analytics.

– Finance: Streamlining operations and risk management with robust AI infrastructure.

– Education: Facilitating personalized learning experiences using AI technologies.

Pros and Cons of Investing in Dell

Pros:

– Established reputation and robust market presence.

– Strong partnerships with key industry players like xAI.

– Proven track record of innovation and strategic foresight.

Cons:

– Share prices may be less volatile, reducing potential high returns compared to emerging startups.

– Faced with increasing competition from other AI-focused companies.

Actionable Recommendations for Investors

– Diversify Investments: Balance your portfolio with a mix of established companies like Dell and promising startups to mitigate risk and capitalize on growth opportunities.

– Stay Informed: Regularly update yourself on AI market trends and regulatory changes.

– Evaluate Long-Term Potential: Focus on companies with sustainable innovation strategies rather than immediate hype.

For more insights into technological innovation and investment strategies, explore Dell Technologies.

As the AI landscape continues to evolve, investors are tasked with discerning between transient trends and enduring innovations. Embracing both foresight and caution will be crucial for capitalizing on opportunities in this dynamic field.