China’s Technological Leap: Jinlongyu’s Bold Push into Solid-State Battery Production

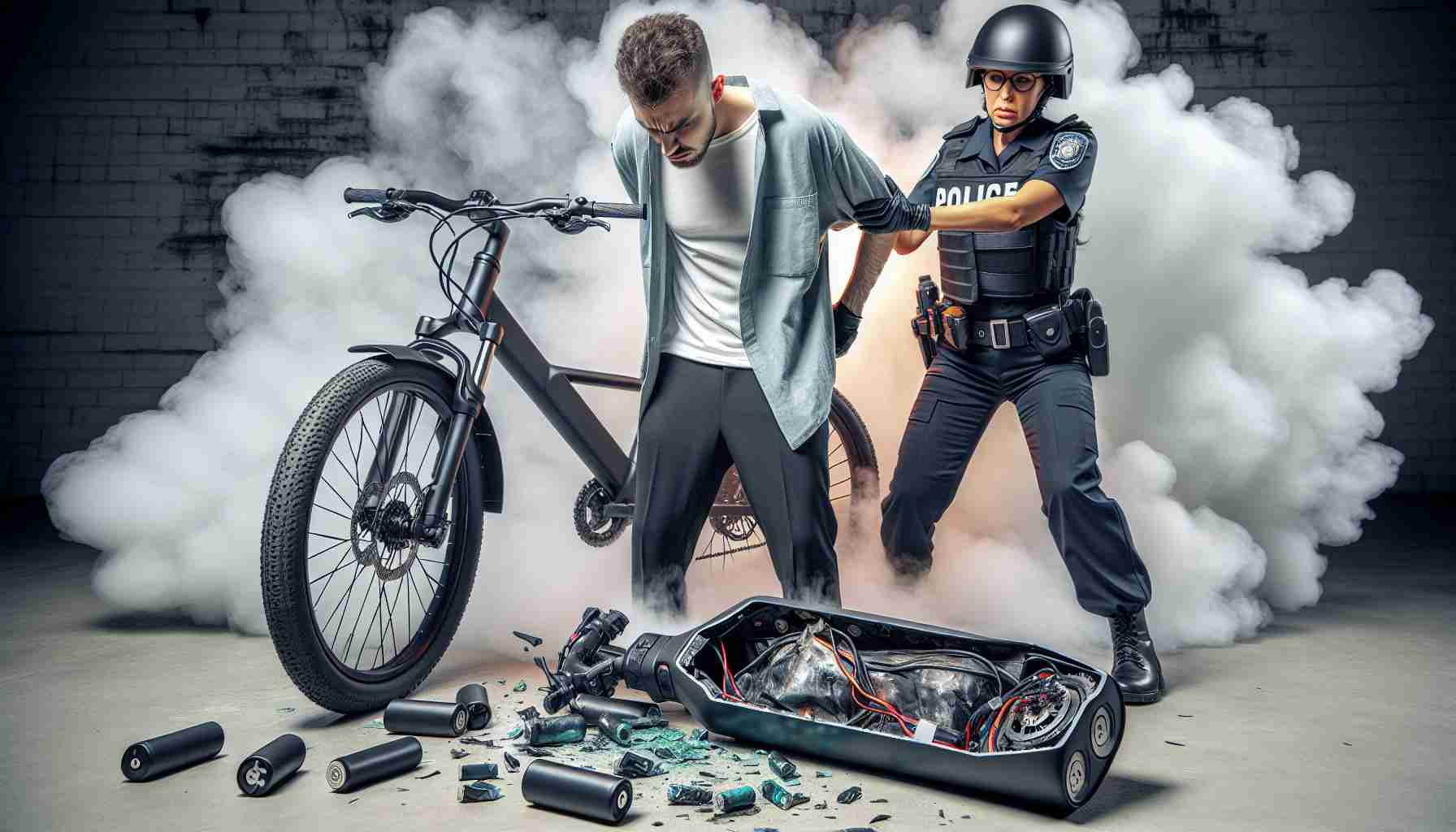

Jinlongyu, known for wire and cable solutions, invests USD 160 million in solid-state battery technology in Guangdong province. Solid-state batteries promise higher energy density